Every year, Grain Growers of Canada (GGC) brings grain producers to Ottawa for Grains Week, a focused day of meetings, discussions and events designed to ensure that growers’ priorities are front and centre with parliamentarians. It is one of the most important advocacy efforts we undertake each year, connecting the realities of grain farming directly to the policy decisions that shape our sector.

This year’s Grains Week featured more than 30 meetings with ministers, secretaries of state, MPs, senators and senior staff, capped off by a well-attended Parliamentary reception that drew more than 150 guests from Parliament Hill. Farmers were divided into regional groups to cover as much ground as possible, sharing how federal decisions impact operations and outlining solutions to strengthen the competitiveness of Canadian grain.

In a single day of co-ordinated meetings, GGC members from across the country met with key decision-makers, beginning with a breakfast meeting with Minister of Agriculture and Agri-Food Heath MacDonald, to discuss how grain farmers and government can work together to advance shared priorities. Throughout the day, producers met with many others, including Leader of the Official Opposition Pierre Poilievre, Parliamentary Secretary to the Prime Minister Kody Blois and Parliamentary Secretary to the Minister of Agriculture and Agri-Food Sophie Chatel.

Meetings also included influential voices such as Finance Committee Chair Karina Gould, Secretary of State for Rural Development Buckley Belanger, Parliamentary Secretary to the Minister of Finance Ryan Turnbull, as well as critics and committee members from across party lines. In the Senate, we met with long-standing agricultural advocates, including senators Rob Black and Mary Robinson.

Across every meeting, our message was consistent: producers are ready to be part of the solution, but they need government to remove the barriers holding the sector back.

Our advocacy focused on four key issues. Farmers emphasized the need to reset Canada’s trade relationships and defend tariff-free access to key markets like the United States and China. With more than 70 per cent of Canadian grain exported, trade disruptions and new tariffs have a direct impact on farm incomes. Attendees urged the government to make agriculture a top priority in trade negotiations and to actively defend CUSMA in the upcoming 2026 review.

The second focus was trade-enabling infrastructure. Canada’s grain supply chain is under pressure, with the Port of Vancouver already at capacity and chokepoints like the Second Narrows Rail Bridge leaving the system vulnerable. Farmers made it clear that without urgent federal investment in ports, rail and bridges, delays will continue to erode both income and market confidence.

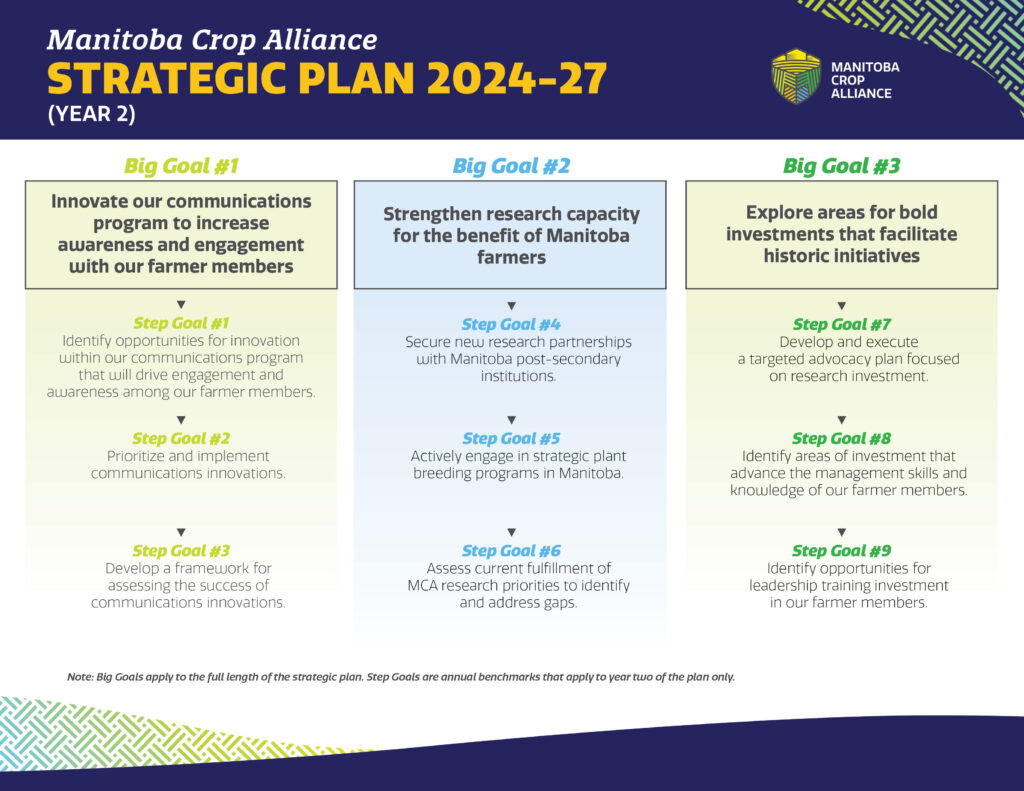

The third issue was the urgent need to reinvest in agricultural research and development. Total public spending in research has declined by nearly $200 million over the past decade, putting farmers at a disadvantage globally. We called for renewed federal support for Agriculture and Agri-Food Canada’s breeding and innovation programs, along with stronger partnerships that keep farmers directly involved in setting research priorities.

Finally, farmers reinforced the need to protect family farms by permanently reversing the capital gains tax increase. While government has signalled a possible reversal, the hike remains scheduled for January 2026, leaving uncertainty for farm families. For producers, their land and equipment are their retirement savings, and this tax would make it harder for the next generation to take over.

Beyond meetings, our message was visible throughout Ottawa. Advertisements downtown and in The Hill Times, along with targeted digital outreach, reinforced farmers’ priorities for trade, infrastructure, research and fair taxation.

The week concluded with GGC’s board of directors meeting and participation in stakeholder receptions, where members connected with industry partners and set advocacy priorities for the year ahead. To cap off the week, we were able to celebrate the association’s first ever recognition, receiving a Canadian Society of Association Executives (CSAE) Award of Excellence for our Protect Family Farms campaign that opposed the capital gains tax hike.

Grains Week is about ensuring farmers are heard where it matters most. By bringing producers face-to-face with decision-makers, we are making sure the future of Canadian grain farming is shaped by those who know it best.